Real-Time BNB Signal Analytics

Real-Time BNB Signal Analytics

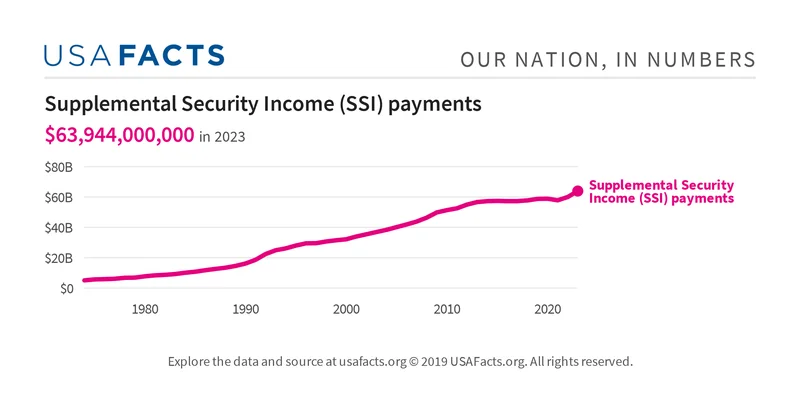

The federal government has been in a state of partial paralysis for 27 days. In the world of 24-hour news, this is presented as a full-blown crisis, sparking a predictable wave of anxiety. For the roughly 75 million Americans who rely on Social Security or Supplemental Security Income (SSI), the primary question is brutally simple: Will the money stop?

The short answer is no. The longer, more useful answer reveals a system that is both more resilient and more subtly fragile than the political theater suggests. The panic is misplaced. The real issues facing beneficiaries have little to do with the current standoff in Congress and everything to do with numbers that were set in motion long before the shutdown began.

Let’s cut through the noise and look at the mechanics.

The first and most critical point to understand is that Social Security and SSI payments are not discretionary. They are classified as mandatory spending, authorized by permanent law. Their budget is not dependent on the annual appropriations drama that shuts down national parks and furloughs federal employees. The system is, by design, an automated financial pipeline largely insulated from the day-to-day whims of Washington.

This is why, despite the shutdown, the payment schedule for November 2025 proceeds without interruption. For standard Social Security recipients, the dates are locked in based on a simple birthdate formula:

* Born 1st-10th: Payment on Wednesday, Nov. 12.

* Born 11th-20th: Payment on Wednesday, Nov. 19.

* Born 21st-31st: Payment on Wednesday, Nov. 26.

The situation for SSI recipients introduces a calendar quirk that often generates confusion. SSI payments are scheduled for the first of the month. But November 1, 2025, is a Saturday. By rule, when the first falls on a weekend or holiday, the payment is issued on the preceding business day. Consequently, November's SSI payment will be sent on Friday, October 31. This creates the illusion of a "double payment" in October and no payment in November, a recurring anomaly that has nothing to do with the shutdown. It’s simply a function of the calendar.

This entire process is becoming increasingly automated. An executive order signed by President Trump mandated a shift away from paper checks, pushing nearly all beneficiaries to direct deposit or Direct Express cards. This move, while perhaps inconvenient for some, further hardens the system against disruption. It’s a machine built to run on a schedule, not on political consensus.

So, if the core function—the delivery of funds—is secure, where does the shutdown actually inflict damage? The answer is at the margins, in the human layer of the system that the automated payments can’t replace.

While the money flows, the Social Security Administration (SSA) itself is operating with a skeleton crew. Thousands of employees are furloughed. This is where the shutdown ceases to be political noise and becomes a tangible problem for millions. The core automated function remains stable, but the human support layer degrades, creating hidden costs and frustrations that don't show up in top-line numbers.

SSA offices remain open, but with a severely limited menu of services. You can still apply for benefits, report a death, or change your address. Critical functions remain. But many routine, yet essential, services have been suspended for in-person visits. You can no longer walk into an office to get a replacement Medicare card or request a proof of income letter. While these services are available online through a my Social Security account, this solution overlooks the significant portion of beneficiaries who are not digitally savvy or lack reliable internet access.

This is the operational friction that a shutdown creates. It doesn’t stop the machine, but it throws sand in the gears. For a senior needing a proof of income letter to secure housing, or someone who lost their Medicare card and has an upcoming doctor's appointment, being told to "go online" is a frustrating, and sometimes insurmountable, barrier. The system’s core promise is met—the check arrives—but the ancillary support that makes the system usable begins to crumble.

This, I would argue, is the real, immediate story. It’s not a dramatic narrative of financial collapse, but a slow, frustrating grind of degraded service. But even this operational slowdown is temporary. The more significant number, the one that will define the financial reality for beneficiaries long after this shutdown ends, was announced quietly just before the political chaos began: the Social Security Announces 2.8 Percent Benefit Increase for 2026.

This is the number that truly matters. This adjustment will increase the average Social Security retirement benefit by about $56 per month starting in January. While any increase is welcome, it’s crucial to place this figure in context. The COLA for 2025 was 2.5 percent, and the average over the last decade has been around 3%—to be more exact, 3.1%. A 2.8% increase represents a continuation of modest adjustments that many argue fail to keep pace with the actual inflation experienced by seniors.

The COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a metric that tracks a basket of goods weighted toward the expenses of a working-age population. But does that basket accurately reflect the spending of a 75-year-old retiree, whose budget is disproportionately consumed by healthcare and housing costs that often outpace general inflation? The data suggests it does not.

So while Washington is consumed by a temporary political fight, the more profound, long-term financial pressure on seniors continues its quiet, relentless march, dictated not by shutdowns, but by a mathematical formula.

The current environment is a perfect case study in signal versus noise. The shutdown is the noise—loud, alarming, and ultimately temporary in its direct impact on benefit payments. The signal is the steady, automated hum of the payment system, combined with the quiet, mathematical reality of a 2.8% COLA that represents a marginal gain in purchasing power. The public focus is on the manufactured crisis, while the structural challenge—ensuring benefits keep pace with the real cost of living—receives far less attention. The checks will arrive in November. The real question is what they will be worth.