Real-Time BNB Signal Analytics

Real-Time BNB Signal Analytics

The financial markets are, as always, fixated on the immediate. This week, the chatter revolves around Visa’s quarterly earnings, with Wall Street analysts plugging numbers into their models, expecting earnings of $2.97 per share on revenue of $10.61 billion. Traders will watch the ticker, react to the beat or the miss, and move on. This is the routine, the quarterly ritual of financial reporting.

But focusing on these numbers is like analyzing the fuel gauge on a car while ignoring the new engine the mechanics just installed. The far more significant development at Visa—the one that will likely define its next decade—wasn't in an earnings report. It was a quiet announcement on October 14th about a new framework called the "Trusted Agent Protocol," developed with Cloudflare.

On the surface, it’s a security tool. Visa claims it’s designed to help merchants distinguish between human shoppers, benevolent AI shopping agents, and malicious bots. It's the corporate equivalent of the classic internet challenge, Are you a robot? The stated catalyst is a reported surge in AI-driven traffic to retail websites, a figure Visa puts at over 4,700% in the past year.

And this is the part of the report that I find genuinely puzzling. A 4,700% increase is an astronomical number, the kind of statistic that demands scrutiny. How is "AI-driven traffic" being defined here? Does it include every automated script and price scraper, or only sophisticated agents designed to execute purchases? The details are conspicuously absent. Without a clear methodology, a number that large feels less like a precise data point and more like a marketing tool designed to justify a strategic pivot. It’s a classic case of creating a narrative to fit the solution you’ve already built.

But let’s set aside the questionable statistic for a moment and look at the solution itself. Because the protocol’s true purpose, in my analysis, has very little to do with just blocking a few bad bots. This is about building a moat.

Most people will see this Trusted Agent Protocol as a simple bouncer at the door of an e-commerce club, checking IDs and keeping troublemakers out. This analogy is fundamentally wrong. A bouncer’s job is binary: you’re either in or you’re out. They don’t log your intentions, your shopping list, or who you plan to talk to once inside. Visa’s protocol is far more ambitious.

A better analogy is a global customs and immigration checkpoint for all AI agents entering the sovereign territory of e-commerce. Before an AI agent can even interact with a merchant’s website, it must present its credentials to Visa’s gatekeeper. It must declare its purpose and prove it comes from a "trusted" source. Visa, in this position, isn't just granting or denying entry; it's creating a comprehensive manifest of all automated commercial traffic.

Think about the data that flows through this checkpoint. Visa will now have a real-time, pre-transaction view of which AI platforms are driving the most commercial activity, what products they are searching for, what pricing they are sensitive to, and which merchants they are targeting. They are moving their data collection upstream—from the moment of payment to the moment of intent.

This protocol allows Visa to map the entire emerging ecosystem of AI-driven commerce before anyone else. Who gets to be a "trusted" agent? Visa decides. What data must be passed to be verified? Visa sets the standard. They are positioning themselves as the indispensable intermediary, the central clearinghouse not just for money, but for the very language of AI commerce. What happens when a new, innovative shopping AI is developed by a startup? Will it have to pay a fee or conform to specific, potentially restrictive, Visa standards to get its agents "verified"? Is this security, or is it the construction of a tollbooth on the main highway of digital commerce?

This isn’t just a defensive move against fraud. It’s an offensive strategy to own the infrastructure layer of the next generation of the internet. While competitors are focused on payment processing speeds and transaction fees (a business with margins that are, to be more exact, always under pressure), Visa is building a proprietary dataset on machine behavior that could be orders of magnitude more valuable.

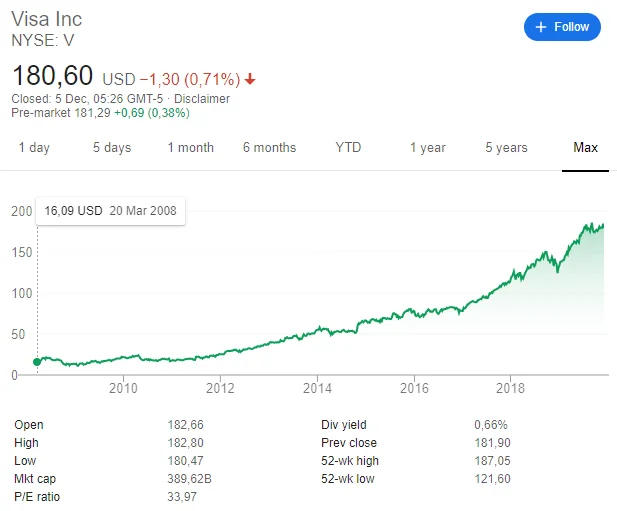

This changes the entire calculus for valuing the company. An analyst at Citi recently put a $450 price target on the stock, citing its dominant network and brand, leading many to ask Is Visa Inc. (V) One of the Top Credit Services Stocks to Buy Amid the US Rate Cut? That’s fair, but it’s an analysis based on the company Visa is today. The Trusted Agent Protocol offers a glimpse of the company Visa wants to be tomorrow: the central bank and intelligence agency of automated economics. The value isn't just in the 2-3% transaction fee; it's in the metadata of every single automated query and interaction that precedes it.

Let’s be clear. The upcoming earnings report will be a footnote in a few months. The market will digest the numbers, and the stock will move a few percentage points. But the launch of the Trusted Agent Protocol is a structural shift. Visa is leveraging its unassailable position in the current payments ecosystem to become the arbiter of the next one. They are building a system where they get a first look at every AI-driven commercial impulse on the internet. This isn't about security; it's about surveillance, data aggregation, and control. It’s a brilliant, almost invisibly strategic move to ensure that no matter which AI platform wins the consumer race, Visa owns the checkpoint through which all their commercial traffic must pass.