Real-Time BNB Signal Analytics

Real-Time BNB Signal Analytics

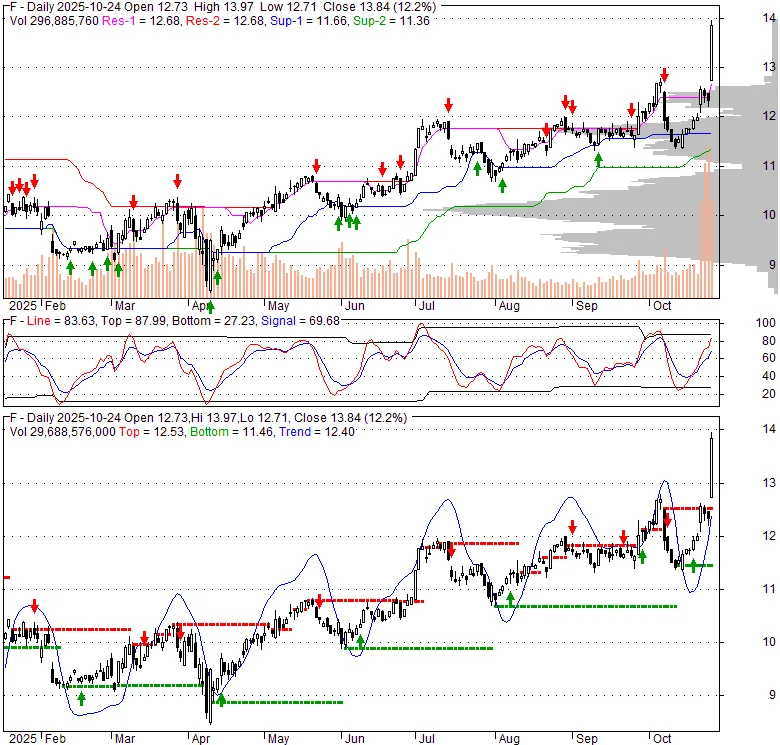

It’s a strange time to be looking at Ford’s stock chart. The line goes up, hitting a 52-week high and surging over 12% in a single day. Investors, it seems, are encouraged. But when you pull up the underlying financials and operational reports, the picture is anything but encouraging. The company just lowered its full-year profit outlook. Its electric vehicle unit is hemorrhaging cash at an astonishing rate. A critical supplier’s factory fire is about to punch a $2 billion hole in earnings.

So, what gives? The market is supposed to be a forward-looking mechanism, but this feels less like foresight and more like willful blindness. The discrepancy between Ford’s soaring stock price and its deteriorating short-term fundamentals isn’t just a curiosity; it’s a case study in how a corporate narrative can decouple from reality. My analysis suggests investors aren't buying Ford’s current performance. They’re buying a story. The question is whether that story has a happy ending or just a well-written first chapter.

Let's be clinical and look at the numbers, because they paint a starkly different picture than the one on the trading screens. In its last quarter, Ford’s EV unit posted its largest loss since 2023, a staggering $1.4 billion. This isn’t a rounding error; it’s a foundational crack in a strategy that was supposed to represent the future. CEO Jim Farley himself admitted that U.S. demand for EVs remains weak.

On top of that, the company is staring down the barrel of a massive supply chain disruption. A fire at the Novelis aluminum plant—a key supplier for the F-150’s iconic body—is projected to reduce production by up to 100,000 vehicles. The financial impact is estimated to be between $1.5 and $2 billion in the fourth quarter alone. Consequently, Ford had to revise its full-year profit guidance downward, from a range of $6.5–$7.5 billion to $6–$6.5 billion.

I've looked at hundreds of quarterly reports, and it's genuinely puzzling to see a stock rally this aggressively on a guidance cut, a supply chain disaster, and ballooning losses in a key growth segment. In any rational environment, this combination of factors would send investors running for the exits. Yet, Ford’s stock jumped to $13.84 (Ford Stock (F) Jumps to 52-Week High as Wall Street Backs Its EV and Recovery Plans). Why? Because the market chose to ignore the data and listen to the anecdote.

The rally wasn't triggered by the numbers. It was triggered by the plan. You can almost hear the collective sigh of relief from traders when Farley shifted the conversation away from the EV cash burn and toward a more pragmatic-sounding solution: hybrids. “We are prioritizing hybrids across our lineup,” he stated, effectively signaling a strategic retreat from an all-in EV push that wasn’t delivering. This, combined with a promise for a new, cheaper EV platform that might deliver a $30,000 electric truck by 2027, was the narrative the market wanted to hear.

It’s like a movie studio announcing its blockbuster film is massively over budget and behind schedule, but then distracting everyone by showing a cool-looking trailer for a different movie that starts filming in three years. The market applauded the trailer and ignored the dumpster fire on the main set.

This reaction is even more telling when you contrast it with another piece of Ford news. The company announced a concrete, long-term plan to recover from the Novelis fire by adding 1,000 workers (900 in Michigan and another 100 in Kentucky) to surge truck production by 50,000 units in 2026. This is a tangible, operational response to a real problem. The market’s reaction? The stock plunged over 4% (Ford Stock (NYSE:F) Plunges With Huge Truck Surge in 2026).

The signal is crystal clear. Investors punished Ford for a plan that involved real-world costs and a distant, two-year timeline to fix a current problem. But they rewarded Ford for a strategic pivot—a story about future efficiency and market adaptation—even though it was presented alongside a sea of red ink. The market isn't investing in Ford's ability to build trucks; it's speculating on its ability to craft a compelling comeback story. But what happens when the next chapter has to be written with actual financial results? And can a company truly build its future on a foundation of what it won't be doing (losing as much on EVs) rather than what it will be doing?

Ultimately, the divergence here is a classic tale of sentiment versus fundamentals. The professional analyst community seems to agree, holding a "Hold" consensus rating on the stock. After a rally of about 22%—to be more exact, 21.72% over the past year—the average price target from Wall Street implies a downside risk of anywhere from 9% to nearly 15%. The experts who model balance sheets for a living are signaling caution, while the market, driven by headlines and narrative momentum, is pushing the price to new highs. This is a fragile equilibrium. Ford’s management has successfully sold a vision of a leaner, more adaptable company. Now they have to actually build it, and the raw materials—from aluminum sheets to quarterly profits—are currently in very short supply.